Your Credit Score Rating

A greater credit score will suggest that the applicant is a dependable one and extra likely to repay their loans and bills on time. Therefore, banks and bank card corporations will give you one of the best (i.e., lower) interest rates, and bank card firms will charge you lower amounts in finance expenses. This way, an excellent credit score will help you save a major amount of money even after taking a mortgage or obtaining a credit card. A credit score rating is important to consider one’s monetary life.

I’ve already written about this, however, as part of this linkage, banks are allowed to tweak your loan interest rate on the premise of adjustments in your credit score profile. If your credit profile worsens, you’ll pay a higher rate of interest on your loan. If it’s strengthening, your reward might be a lower interest rate. A credit score is used to resolve how likely you’ll find a way to repay the loan that you’ve taken from the financial institution. The mortgage interest rate is another criterion that gets impacted by your credit score.

Safeguarding Funds Security In A Digitally Connected World

There are some key advantages of really having a great enterprise credit score rating. It is as a lot as the house owners to maintain that score and guarantee it falls within the focused sector. The finest way to maintain your credit utilization in verify is to pay your bank card balances in full each month. Also, elevating your credit score restrict can help your credit score utilization.

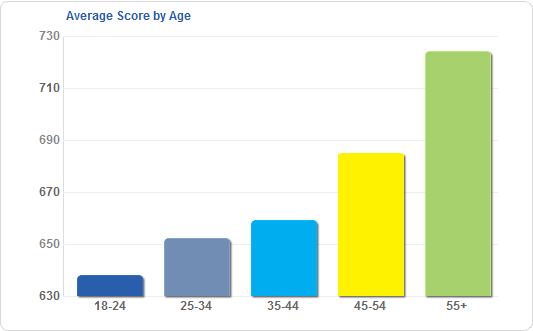

Average credit score for a 22-year-old

Consumers in Their 20sCredit Scores Among Consumers in Their 20sAgeAverage FICO® Score 2266423662246607 more rows•23-Mar-2020

FICO score is commonly checked by lenders to be able to assess a borrower’s credit score history. FICO rating plays an essential function in the assessment of credit dangers. Hence, it is extremely important to hold up a good credit rating. An excessive credit score is unquestionably an asset when it comes to loan and credit card applications. A high credit score implies that you have got good financial history and lenders express excessive confidence in extending credit to such individuals.

Hampering Credit Rating

A Fico rating also permits anybody seeking credit to get truthful and fast entry to loans when required. As FICO Scores are calculated based on your credit data, you presumably can preserve a good rating by paying your payments on time, minimizing debt, and making sensible credit score decisions. In order to enhance your credit score, begin by paying your bank card payments on time. If you’ve availed of any loans previously, ensure you repay the mortgage amount within the specified tenure which in flip will improve your credit rating. Sometimes, your credit score rating could get affected because of an error.

What’s a fair credit score 2020?

Your credit score rating is necessary as a result of it showcases how reliable or risky you are as a borrower. Thus, it has a direct impact on how eligible you are for a loan, what the lender will offer you as a mortgage quantity, and the rate of interest you’ll be charged. Your credit score rating allows lenders to evaluate the potential risk in lending you cash. This is why your credit score score is especially important in relation to unsecured or collateral-free loans and can affect your eligibility for private loans to a great extent. Before a loan is granted to a customer, the lending financial institution or financial institution carries out various checks to be sure that the customer will repay the loan along with the curiosity due. One such examination that affects the financial institution’s determination to lend to you is your credit score rating.

Would My Score Be Affected If I Verify My Credit Score?

Closing your old credit score accounts may have an adverse influence in your credit score- Individuals with old credit score accounts prove that they have managed their credit score responsibly in the past. Therefore, banks favor lending cash to folks with old credit accounts to new credit accounts. This range indicates that you have a quantity of default payment for a number of credit merchandise. You could have little or no chance of obtaining new credit/any form of loan in the future. To come out of this stage, you could want help from a monetary advisor who can information you to do the identical.

How can I raise my credit score by 100 points in 30 days?

How to improve your credit score by 100 points in 30 days

1. Get a copy of your credit report.

2. Identify the negative accounts.

3. Dispute the negative items with the credit bureaus.

4. Dispute Credit Inquiries.

5. Pay down your credit card balances.

6. Do not pay your accounts in collections.

7. Have someone add you as an authorized user.

Separation and divorce are these troublesome instances when you must take a break from a not-so-happy relationship or in some instances even finish it. It is important that you find out your finances embody any joint loans or credit cards to keep away from further agony in the future. Here is what you can do to stop yourself from stepping into uncomfortable financial conditions. In the current risky world financial setting job, losses, or business eventualities could drive a scenario of lowered income. Managing current credit commitments within the context of these situations of decreased revenue poses a monetary challenge and presents another probably credit score crossroad that we may have to grasp the means to deal with.

What Type Of Data Is Included In A Credit Report?

Only 8% of applicants in this rating vary are more probably to become significantly delinquent in the future. Applicants with scores in this range are thought to be subprime debtors. All you must do is share a couple of primary details and take a look at your pre-approved provide. Borrowing more loans sooner or later with outstanding debts can create a serious reimbursement burden and even cause bankruptcy.

Do lenders look at Equifax or TransUnion?

Any excessive spending can result in a fall within the credit score of both you and the owner of the cardboard. An individual with no debt usually has a really low or negligible credit score rating. However, you have never taken a loan and even used a credit card before. Maintaining a great credit score is a crucial component of economic planning.

What’s A Nasty Cibil Score?

Too many exhausting inquiries in a brief interval would possibly decrease a person’s credit rating. In other phrases, it means checking a person’s creditworthiness. A credit inquiry occurs when there’s a legally permitted request from an organization or individual to examine the credit score score of a person. Every credit bureau has its model to generate a credit score report.

You can have up to four addresses which may embody permanent, temporary, and workplace addresses. For instance, if there’s an excessive variety of inquiries made by different lenders on you, it exhibits that you might have approached a number of lenders for loans if those loans have been taken or not. If you may have just lately utilized for a few loans, this makes you look ‘credit hungry’. Here’s how the scores are associated to the monetary well-being of a person.

The Significance Of Credit Rating

Credit Mix – Having the correct mix of secured and unsecured loans helps with the credit score. A Credit Score is basically a number that is an abstract of your credit historical past. If your credit score score is near 300, then it is extremely poor and you should take action to improve it. But if your credit score score is close to 900 then you’ve managed to keep a really good credit history. Regular payments are a should. Regardless of what your dues might be – credit card payments, loan EMIs, or the rest along the identical strains – just make sure you by no means default in your funds. Be it getting automobile insurance coverage or insuring your house, your credit rating plays a significant position in defining your premium.

What FICO score is needed to buy a house?

CUR or the Credit Utilization Ratio is the quantity used out of the entire credit quantity provided by the financial institution. Spending around 30% of your complete credit amount is considered apt. However, expenses made more than that and even equal to the given amount impacts in lowering the credit score.

Who Can See My Credit Score Report?

These embrace credit cards and any kind of mortgage, for example, personal, auto, or house loans and overdrafts. Often individuals don’t realise that purchasing a mobile phone in installments is technically a mortgage and subsequently can have an effect on your credit score report. As you have to pay other bills properly, you might forget to pay your credit card bills which may affect your credit score. You can arrange cost reminders or writing down the payment deadlines as paying your payments constantly can improve your score.

Factors similar to complete debt, repayment historical past, credit score utilization, credit score kind, and whole credit accounts determine one’s credit score rating. Singhal stated it is important for customers to build their credit score footprint to enable the banking system to judge their creditworthiness. “Many individuals find yourself with a poor credit score history as an end result of unawareness or lack of self-discipline,” he stated. Typically, a score above 720 is considered excellent and anything beneath 300 is taken into account as very poor. A CIBIL credit score can be defined as a 3 digit numeric outline of your credit history. It is calculated on the basis of your complete borrowing particulars such as repayment document, reimbursement pattern, the quantity and type of loan accounts and outstanding money owed, and default instances.

What Does My Credit Score Range Imply?

Although lenders have a glance at your Credit Score earlier than contemplating your mortgage or Credit Card software, additionally they look at numerous other elements too, such as your revenue, employment history and so on. But you can be relaxation assured that if your Credit Score is good, the chances of loan refusal is low and you’ll get higher charges than someone with just a mean score. Given the increasing significance of the credit rating, make sure to monitor it regularly. You can at all times discover loans from digital lenders like Indifi and provides wings to your private and nicely as business targets.

CIBIL Score is a three-digit numeric summary of your credit score’s historical past, derived through the use of details found within the ‘Accounts’ and ‘Enquiries’ sections on your CIBIL Report and ranges from 300 to 900. An online platform that allows you to select from a quantity of provides across merchandise and participating lenders, all in a single view. Get a personalized loan and bank card presents based mostly in your CIBIL Score and Report. A good credit score rating makes one eligible for the best bank cards obtainable out there.

Grasp Of Enterprise Administration

Credit enquires record the occasions the place third events have accessed your credit report inside a span of 2 years. Every time a lender checks your credit score report, it’s counted as an inquiry. Though you can view all credit score inquiries, lenders or monetary companies may find a way to view solely a small cross-section. Keep in thoughts that these inquiries are results of credit card or mortgage inquiries that you’ve made. So, a potential lender may see a number of credit inquiries in your credit report and surmise that you have made many mortgage functions within the latest previous.

- Your credit score rating will improve if you manage to maintain a low credit utilization ratio.

- In such a state of affairs, and schooling mortgage is the finest way to fund your education in a seamless and hassle-free manner.

- Before you apply for the mortgage, you must always keep in mind the necessity and urgency for the loan.

- A greater rating signifies a less dangerous borrower and increases your possibilities of getting a loan accredited.

- As mentioned earlier, the Credit Score is a reflection of the creditworthiness of the borrower.

- So a loan approval by one lender would possibly require the minimal rating to be 750, another might settle for seven-hundred and even lower.

- “Everyone needs to check and observe their credit score scores, a minimum of once each three months, even when you don’t want a loan within the foreseeable future.

- There are varied fashions for calculating credit score scores and every time a lender requires a credit score rating, the credit score scores are calculated on the scoring mannequin of the lender’s selection.

If a house loan is what you might be relying on together with qualifying for the bottom potential price, examine your score to ensure there is nothing amiss in the credit history. A credit score score is a numeric value that displays an individual’s creditworthiness. The score is set upon considering numerous components with respect to the reimbursement of debit and credit score profiles. Moreover, a credit rating is simply a part of the credit report. A credit report covers an individual’s entire credit history, pertaining to loans and bank cards.

Background Of Credit Score Score In India

These articles, the data therein, and their different contents are for info purposes only. All views and/or recommendations are these of the involved creator personally and made purely for data purposes. Nothing contained in the articles should be construed as enterprise, legal, tax, accounting, investment or different advice or as an advertisement or promotion of any project or developer or locality. Experian PLC, a worldwide client credit score reporting firm, headquartered in Ireland, has its branches in varied international locations together with India.

Various authorities banks have now marketed their loan fee break-ups and have additionally provided clarity on how the charges are computed with respect to the borrower’s credit profile. Bank of Baroda, for instance, will reserve its lowest home loan rates for debtors with credit score scores between 760 and 900 – eight.1%. For borrowers with credit scores between 726 and 759, the speed is eight.35%, and for these with scores below 726, the rate is 9.1 percent. The background to those developments is that the RBI had mandated banks to implement external benchmarking by October 1. Government banks have shown a choice for the repo rate while one international financial institution had already linked its loan to the three-month Treasury Bill yield.

Attempt To Keep A Wholesome Mixture Of Credit Score

But when you take the mortgage, it is better to make sure that there’s a healthy mix of secured and unsecured loans. While the home loan and car mortgage count for a secured loan, your credit card debt or private loans are considered unsecured loans. It is critical to maintaining a balance since taking any loan in access can affect your credit rating. Even though the above-mentioned factors do not have an effect on your credit standing, it is important that payments are made on time, regardless of the impact in your rating. Also, if you’re an individual with a loan or credit card, you should hold a verify in your credit score rating and avail your free credit score reviews as soon as a month to track your progress.

And these premiums can considerably improve your month-to-month funds. But the APR you pay for a loan is often equal to or even more essential than the bottom interest rate. As lengthy as you make all of your loan functions within a specified period, your score ought to take the same small bump for 10 functions as it does for one.

Us Recognises India Is Important A Half Of Dialog On Afghanistan: Exam

A credit score historical past is a report of a borrower’s repayment of money owed. A credit report is a record of the borrower’s credit score’s historical past from a selection of sources, including banks, bank card corporations, collection businesses, and governments. A borrower’s credit rating is the result of a mathematical algorithm utilized to credit information to foretell how credit scores worthy you may be.

information corp, a world media, e-book publishing, and digital actual property services company, is the important thing investor in Elara. Elara’s other major traders embody saif partners, accel partners, and RB Investments. All home mortgage candidates attempt to get a mortgage on the lowest attainable interest rate.